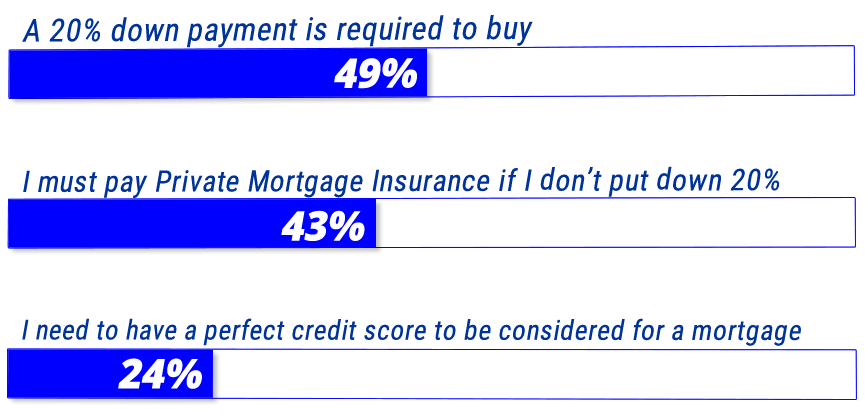

Many renters still believe persistent myths about homebuying, including…

Myth #1: A 20% down payment is required to buy.

Many people believe that buying a home is out of reach, as it will take years to save 20% for a down payment. Good news! You can put down less than 20%! In fact the average down payment for first-time homebuyers in 2017 was 5%, and 10% for repeat buyers, according to the National Association of REALTORS. And, it’s possible to put down even less!

Your down payment can come from sources other than just your personal savings, such as an inheritance or a gift from a family member, stocks or mutual funds, and even a retirement portfolio. The requirements vary based on the loan type. Keep in mind that homebuyers purchasing a primary residence will always have lower down payment requirements than an investor or someone purchasing a second home.

Myth #2: I must pay Private Mortgage Insurance if I don’t put down 20%.

PMI is generally required by the lender when a borrower purchases a home using conventional financing with less than a 20% down payment. But, there are other loan programs available that don’t require PMI. Also, there’s other loan programs with possible reduced mortgage insurance, so be sure to do your research to find out what best fits you and your family’s financial situation.

Private Mortgage Insurance, or PMI, is an insurance policy that protects the lender if you are unable to pay your mortgage. It’s paid for by the homeowner, but benefits the lender.

This is where most home buyers get hung up. They don’t like the idea of paying an insurance policy that protects the lender. It should benefit the buyer, the logic goes…but, PMI is not completely one-sided.

PMI benefits the buyer in a number of ways, most prominently by reducing the down payment required to buy a home. Buyers can make the initial home purchase now, instead of saving for years or decades toward the 20% down payment, which in turn benefits the buyer, who starts building wealth immediately.

PMI is not permanent. It drops off after five years due to increasing home values and the decreasing of the loan principal.

Myth #3: I need to have a perfect credit score to be considered for a mortgage.

You don’t need perfect credit to qualify for a home loan. When a lender is considering you for a home loan, they are simply looking for your ability to repay your mortgage, without the risk of you defaulting on the loan.

With a higher credit score, interest rates will likely be lower. A lower credit score may mean higher interest rates, but that doesn’t disqualify you. A less than perfect credit score may come at different terms, but with steady employment or other sources of verifiable income, along with other adequate assets, you can still qualify for a loan with less than perfect credit.

Sources:

https://info.bankofamerica.com/homebuyers-report/

https://www.thebalance.com/the-myth-of-20percent-down-payment-when-buying-your-home-2395233

https://themortgagereports.com/18520/20-percent-downpayment-risk-mortgage-interest-rate

http://www.freddiemac.com/blog/homeownership/20160818_myth_vs_fact_pmi.page